Trade Like a Market Maker By James Ramelli – AlphaShark

$99.00 Original price was: $99.00.$15.40Current price is: $15.40.

Trade Like a Market Maker: A Comprehensive Review of the Course by James Ramelli – Digital Download!

Trade Like a Market Maker By James Ramelli – AlphaShark

Overview

Mastering the Art of Market Making: A Full Course Review by James Ramelli

In today’s fast-moving financial world, achieving trading success requires more than mere luck—it demands a profound understanding of advanced strategies, often developed by professional market makers. James Ramelli’s “Trade Like a Market Maker,” offered through AlphaShark Trading, provides exactly this: an advanced toolkit to elevate a trader’s capabilities. By delving into the methods employed by market makers, participants gain not only enhanced trading performance but also the skills to succeed in increasingly complex financial environments. This review will outline the course’s content, key techniques covered, and how they benefit both novice and experienced traders.

An Overview of the Course Content

The course, “Trade Like a Market Maker,” is designed to provide a comprehensive understanding of the key concepts and advanced strategies employed by professional market makers in their trading activities. James Ramelli walks participants through essential techniques that can help traders thrive in a world dominated by high-frequency and algorithmic trading.

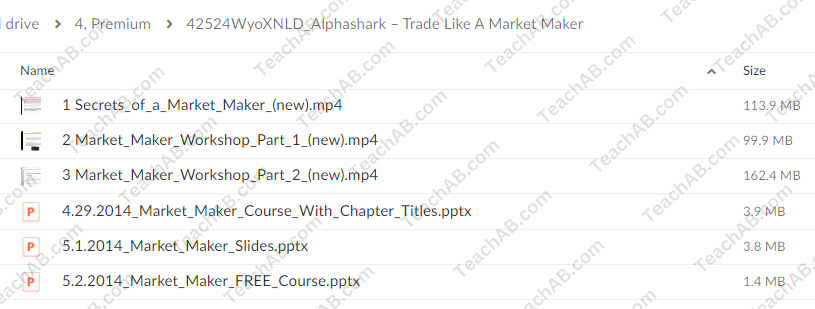

Spanning eight hours, the course offers lifetime access, giving participants ample opportunity to revisit the material and adapt their strategies as market conditions evolve. In an industry where trends change rapidly, this ongoing access ensures that traders can keep their strategies updated, continually improving their trading approaches.

One of the most critical aspects of the course is understanding market makers’ role. Unlike regular traders, market makers actively provide liquidity, placing their own capital on the line and profiting from the bid-ask spread. By embracing these methods, participants position themselves to make informed decisions and navigate the complexities of modern markets.

Effective Risk Management with Hedging Techniques

A highlight of this course is its detailed exploration of hedging, a strategy essential for risk management. Market makers excel in protecting their capital by carefully managing their exposure, particularly in volatile market conditions. This section of the course teaches traders hands-on techniques for minimizing risk, an invaluable skill for anyone serious about trading.

The course covers protective strategies, such as using options to hedge against risk. For example, when holding a long position, using put options can act as a safeguard against potential losses. This approach allows traders to mitigate the impact of negative price movements, preserving their capital.

Hedging is crucial in today’s volatile market, where external factors like geopolitical events and economic reports can cause significant price fluctuations. Mastering these techniques allows traders to move beyond speculation and instead make decisions based on careful risk assessment.

Mastering Implied Movement Analysis

Another key component of the course is implied movement analysis, which teaches traders how to interpret trading activity to forecast price movements in underlying assets. Rather than relying on guesswork, participants learn to make informed decisions by analyzing real-time market data.

Ramelli places strong emphasis on factors such as volume fluctuations, open interest, and the relationship between options pricing and the asset’s underlying value. For example, a significant increase in call options relative to puts may signal a bullish outlook, while a spike in put buying could suggest a bearish trend.

This skill empowers traders to anticipate market shifts, enabling them to adjust their positions proactively rather than reacting to movements after they happen.

Key Market Making Strategies You Will Learn

At the core of the “Trade Like a Market Maker” course is a suite of strategies derived from market makers’ proven methods. Here’s a summary of some of the primary strategies discussed:

-

Call-Put Ratio: A tool used to measure market sentiment, helping traders assess whether the market is leaning bullish or bearish.

-

Market Maker Targets: This technique focuses on options trading strategies, particularly in low-volatility environments, to help traders achieve consistent returns.

-

Optimal Timing for Market Moves: Understanding the best moments to enter and exit trades is key to maximizing profit, especially when dealing with credit and debit spreads.

-

Maximizing Profit Potential: The course shares insights on how to leverage market maker methods to generate significant profit margins, potentially up to 600%.

Summary of Key Market Making Strategies

| Strategy | Objective | Core Insight |

|---|---|---|

| Call-Put Ratio | Gauge market sentiment | Measures whether the market is bullish or bearish |

| Market Maker Targets | Optimize options trading in low volatility | Helps in using options strategies effectively |

| Optimal Timing | Fine-tune timing for trades | Identifies the best moments to enter and exit |

| Profit Maximization | Achieve high returns | Applies market maker strategies for greater profits |

These strategies, when executed correctly, provide traders with a robust foundation to transition from theory to practice, enhancing their real-world trading performance.

Course Format and Accessibility for Traders

One of the course’s most appealing features is its accessible format. The eight-hour bootcamp is designed to offer practical, real-world insights into the trading landscape. Participants can revisit the material anytime, making it easy to review specific concepts as needed.

With 24/7 access to course materials, traders can learn at their own pace, accommodating their individual schedules. This flexibility is critical for those whose trading commitments might conflict with traditional learning formats.

The course also promotes community interaction, allowing participants to engage with fellow traders, share strategies, and discuss ideas. This collaborative environment enhances the learning process and creates a network of like-minded individuals.

Cost and Access: A Worthwhile Investment

At its regular price of $999, “Trade Like a Market Maker” is a notable investment. However, the value is further enhanced by periodic promotions and discounts, which lower the cost, making the course more accessible to traders at all levels.

Given the advanced nature of the content and the potential for significant returns through the application of market maker strategies, the course represents a wise investment for those looking to improve their trading skills.

Target Audience for the Course

The course is designed for traders of all experience levels. Beginners will benefit from the foundational knowledge provided, while seasoned traders will find advanced strategies that can refine their techniques and increase profitability.

For experienced traders, the course offers fresh insights and sophisticated techniques that can enhance existing strategies. Its clear and structured delivery ensures that even complex topics are easy to understand and implement.

Final Thoughts

In conclusion, James Ramelli’s “Trade Like a Market Maker” provides essential tools and strategies to help traders succeed by mimicking the methods of professional market makers. With detailed hedging techniques, insightful implied movement analysis, and advanced strategies, this course equips traders with everything they need to navigate today’s dynamic financial markets. Mastering these strategies can significantly boost a trader’s chances of success, helping them move beyond speculation and become more confident and informed investors. Whether you’re new to trading or looking to enhance your expertise, this course is a valuable resource for anyone looking to elevate their trading game.

Frequently Asked Questions:

Business Model Innovation: We operate a group buying strategy, allowing participants to share costs and access popular courses at reduced prices. This model benefits individuals with limited financial resources, despite concerns from content creators about distribution methods.

Legal Considerations: The legality of our operations involves complex issues. Although we don’t have explicit permission from course creators to resell their content, there are no specific resale restrictions stated at the time of purchase. This ambiguity creates an opportunity for us to provide affordable educational resources.

Quality Control: We ensure that all course materials purchased are identical to those offered directly by the creators. However, it’s important to understand that we are not official providers. As such, our offerings do not include:

– Live coaching calls or sessions with the course author.

– Access to exclusive author-controlled groups or portals.

– Membership in private forums.

– Direct email support from the author or their team.

We aim to reduce the cost barrier in education by offering these courses independently, without the premium services available through official channels. We appreciate your understanding of our unique approach.

Be the first to review “Trade Like a Market Maker By James Ramelli – AlphaShark” Cancel reply

You must be logged in to post a review.

Reviews

There are no reviews yet.