Mastering the Gaps – Trading Gaps

$399.00 Original price was: $399.00.$15.40Current price is: $15.40.

Mastering the Gaps: An In-Depth Review of Trading Gaps – Digital Download!

Mastering the Gaps – Trading Gaps

Overview

An Extensive Review of “Mastering the Gaps” in Trading

In the world of financial markets, traders often encounter unique opportunities that require specialized strategies to capitalize on. One such strategy gaining attention is gap trading, a technique that exploits price discontinuities between candlestick formations. The Mastering the Gaps course has been carefully designed for traders looking to deepen their expertise in this area. Combining practical application with theoretical foundations, this course offers a comprehensive pathway for individuals eager to enhance their trading acumen.

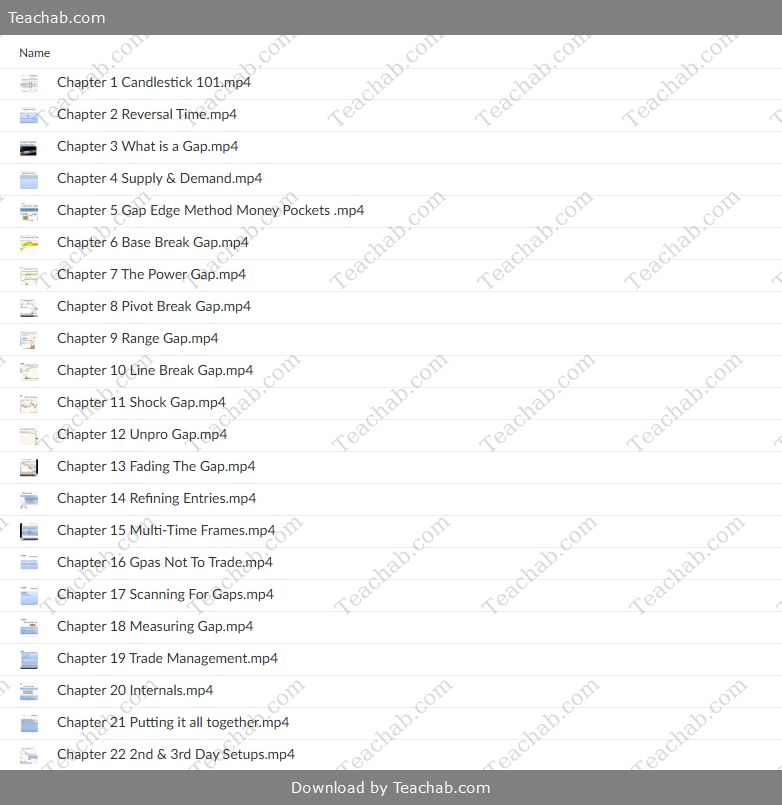

This course presents an organized learning approach, providing over eight hours of on-demand content divided into 23 chapters. This flexible format enables traders to engage with the material at their own pace, gaining an in-depth understanding of gap trading methods and how to apply them in real-world situations.

Defining and Categorizing Price Gaps

Price gaps appear on charts when there is a price difference between the previous day’s close and the current day’s open, representing a shift in market sentiment. These gaps can be triggered by various factors, including news releases, earnings reports, or significant economic events. Mastery of gap analysis is essential for traders interested in utilizing this strategy effectively.

The course covers four primary types of price gaps:

-

Common Gaps: Frequently occurring but often lack significant market implications. These gaps tend to fill quickly.

-

Breakaway Gaps: Indicating the start of a new trend, often occurring when price breaks free from a defined trading range, supported by high volume.

-

Continuation Gaps: Known as runaway gaps, these indicate that a trend is likely to persist, continuing in the same direction.

-

Exhaustion Gaps: These gaps typically signal the end of a trend and potential reversal, though they can be riskier to trade.

Understanding these gap types equips traders with the skills to predict market movements, boosting their chances of making profitable trades.

Key Gap Trading Strategies: Gap and Go, Gap Fill, and Fading the Gap

The course explores several strategies designed to exploit gaps, with a focus on three key approaches: Gap and Go, Gap Fill Trading, and Fading the Gap.

-

Gap and Go Strategy: This strategy involves entering trades in the direction of the gap immediately as the market opens. For success, traders look for high volume that supports the gap’s movement. The first post-market candle plays a pivotal role in confirming the trade. By entering quickly, traders can leverage the momentum created by gaps.

-

Gap Fill Trading: This approach predicts that the price will revert back to its prior closing level. Traders use this strategy after identifying specific price actions that suggest a reversal. A strong understanding of market psychology is required to execute this strategy effectively.

-

Fading the Gap: In contrast, fading involves betting against the direction of the gap, with the expectation that the price will return to its pre-gap level. Though potentially rewarding, this strategy is riskier and demands strong signals of reversal.

Comparing Gap Trading Strategies: Risk and Suitability

| Strategy | Approach | Risk Level | Ideal Conditions |

|---|---|---|---|

| Gap and Go | Entering in the gap’s direction | Moderate to High | High volume following market opening |

| Gap Fill Trading | Expecting price to return to prior closing level | Moderate | Price action showing signs of reversal |

| Fading the Gap | Trading against the gap’s movement | High | Strong reversal indicators |

These strategies cater to various risk tolerances and market scenarios, providing traders with a range of options depending on their preferences and analysis.

Essential Tools and Indicators for Gap Trading

For successful gap trading, traders must rely on a variety of technical indicators and tools. The course stresses the importance of integrating these tools into a comprehensive trading plan:

-

Moving Averages: These are used to smooth price data and confirm trends, helping traders decide whether to follow the gap’s direction.

-

Volume Analysis: A crucial tool for identifying market sentiment, especially when high volume accompanies a gap, signaling strong price movement.

-

Pre-Market Scanners: These scanners assist traders in identifying stocks that show significant pre-market activity, offering early insight into potential gaps.

Additionally, the course emphasizes the importance of risk management strategies, such as setting stop-loss orders and managing position sizes. This helps traders minimize risk in the volatile environment typical of gap trading.

Market Context: Where Gaps Are Most Frequently Seen

Gaps primarily occur in stock markets due to structured trading hours, which create opportunities for sudden price changes. Key events such as earnings reports, geopolitical news, or economic announcements can trigger these gaps.

On the other hand, the forex market operates continuously, making gaps less common as prices tend to change gradually rather than in sharp movements. The course highlights these differences, enabling traders to adjust their strategies based on the unique characteristics of the market they’re trading in.

Psychological Resilience in Gap Trading

While technical knowledge is essential, psychological strength plays a key role in trading success. The Mastering the Gaps course underscores the importance of emotional control when dealing with the volatility inherent in gap trading. Emotional impulses driven by fear or greed can lead to poor decision-making and substantial losses. Traders are encouraged to stay disciplined and stick to their strategies, even in challenging market conditions.

Building emotional resilience involves recognizing emotional triggers, staying focused on market dynamics, and adhering to a trading plan. Such mental discipline can be the difference between consistent success and failure in gap trading.

The Role of Discipline in Successful Trading

-

Develop a Clear Trading Plan: Establish firm criteria for entry, exit, and risk management.

-

Emotional Control: Recognize emotional reactions and make decisions based on logic.

-

Continuous Learning: Stay informed of market trends and adjust strategies as needed.

Conclusion: A Vital Resource for Gap Trading Mastery

In conclusion, the Mastering the Gaps course provides a well-rounded education on gap trading, covering both the theory and practical aspects of this strategy. By learning to recognize and analyze price gaps, understanding effective trading strategies, and cultivating the psychological discipline necessary for success, traders can effectively harness the opportunities presented by gaps. This course is a valuable resource for traders looking to sharpen their skills and achieve greater success in the dynamic world of gap trading.

Frequently Asked Questions:

Business Model Innovation: We operate a group buying strategy, allowing participants to share costs and access popular courses at reduced prices. This model benefits individuals with limited financial resources, despite concerns from content creators about distribution methods.

Legal Considerations: The legality of our operations involves complex issues. Although we don’t have explicit permission from course creators to resell their content, there are no specific resale restrictions stated at the time of purchase. This ambiguity creates an opportunity for us to provide affordable educational resources.

Quality Control: We ensure that all course materials purchased are identical to those offered directly by the creators. However, it’s important to understand that we are not official providers. As such, our offerings do not include:

– Live coaching calls or sessions with the course author.

– Access to exclusive author-controlled groups or portals.

– Membership in private forums.

– Direct email support from the author or their team.

We aim to reduce the cost barrier in education by offering these courses independently, without the premium services available through official channels. We appreciate your understanding of our unique approach.

Be the first to review “Mastering the Gaps – Trading Gaps” Cancel reply

You must be logged in to post a review.

Transgender & Gender Non-Binary (TGNB) Clients: Clinical Issues and Treatment Strategies By lore m dickey - PESI

Transgender & Gender Non-Binary (TGNB) Clients: Clinical Issues and Treatment Strategies By lore m dickey - PESI  Using EMDR Across the Lifespan By Robert Tinker - PESI

Using EMDR Across the Lifespan By Robert Tinker - PESI

Reviews

There are no reviews yet.