The Expected Return Calculator

$249.00 Original price was: $249.00.$23.10Current price is: $23.10.

Understanding the Expected Return Calculator: A Comprehensive Review – Digital Download!

The Expected Return Calculator

Overview

Mastering the Expected Return Calculator: A Detailed Analysis

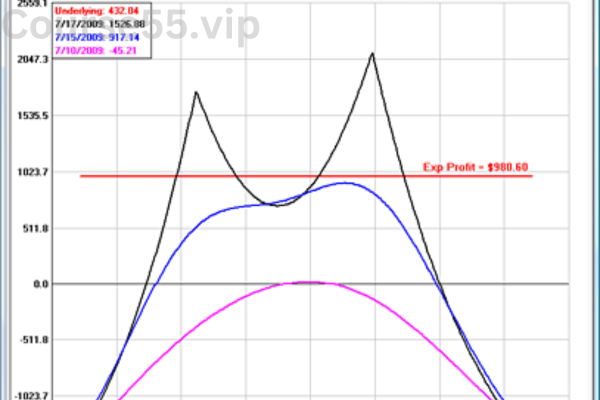

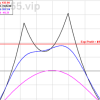

Navigating the investment landscape requires a strategic approach, and the expected return calculator serves as a crucial tool in this process. Designed for both beginners and experienced investors, this calculator provides a structured way to assess potential investment performance by analyzing the probability distribution of asset returns. Whether you’re exploring stock markets or constructing a diversified portfolio, understanding how to utilize this tool effectively can significantly influence financial decision-making. This article delves into its mechanics, advantages, and practical applications to help refine your investment strategies.

Understanding the Expected Return Calculator

The expected return calculator is a valuable resource for estimating how different investment assets may perform under varying economic conditions. Users input relevant data, such as the probability of economic scenarios and their associated returns, which are typically arranged in a tabular format for clarity.

The core calculation follows a straightforward formula:

[ e(r) = sum_{i=1}^{n} p_i cdot r_i ]

In this equation, ( e(r) ) denotes the expected return, ( p_i ) is the probability of state ( i ), and ( r_i ) represents the return associated with that state. This mathematical approach enables investors to grasp the average return they might expect from their investments over time, with the probability factor providing context on how likely each outcome is to occur.

Key Features and Metrics of the Calculator

The expected return calculator generates several key financial metrics essential for investment analysis:

• Expected Return: A benchmark figure that provides insight into potential earnings based on varying probabilities of returns. This helps investors compare different assets effectively.

• Variance: This metric quantifies the dispersion of returns, highlighting the degree of risk associated with an investment. A higher variance suggests greater volatility.

• Standard Deviation: Closely tied to variance, standard deviation measures how much actual returns may deviate from the expected return. A lower standard deviation indicates a more stable investment, whereas a higher value signals increased risk.

These insights enable investors to assess both the potential rewards and associated risks of different investment opportunities, leading to more informed decisions.

User-Friendly Experience and Accessibility

One of the most appealing aspects of the expected return calculator is its intuitive interface, which makes it accessible to investors of all experience levels. Users simply enter probabilities and anticipated returns for different economic conditions, and the calculator quickly processes the data.

After inputting the necessary figures, a single click produces the expected return, variance, and standard deviation, simplifying the evaluation of multiple investment options. This efficiency allows investors to make quick yet well-informed comparisons between assets, ensuring optimal financial choices.

For instance, when analyzing multiple stocks, the calculator doesn’t just indicate which stock might yield higher returns—it also highlights the relative risk associated with each option. This dual analysis makes the tool invaluable in investment planning.

Practical Investment Applications

Investors can apply the expected return calculator in various real-world scenarios. Consider a comparison between Company A and Company B, where an investor examines their potential returns based on different economic probabilities:

| Investment | Probability of High Return (%) | High Return (%) | Expected Return (%) |

|---|---|---|---|

| Company A | 50% | 15% | 7.5% |

| Company B | 30% | 20% | 6% |

In this example, Company A shows a higher expected return; however, investors must also assess risk factors such as variance and standard deviation. Using the calculator, investors can evaluate which option best aligns with their risk tolerance and financial objectives.

This methodology is particularly valuable in volatile markets, where returns fluctuate based on numerous economic variables. The expected return calculator helps investors navigate uncertainty with confidence, enabling them to make well-reasoned choices.

Advantages of Using the Expected Return Calculator

• Data-Driven Investment Decisions: The calculator empowers investors with analytical insights, reducing reliance on speculation and emotional investing. This approach promotes rational decision-making.

• Portfolio Optimization: For those managing diverse portfolios, the calculator helps balance risk and return, allowing for strategic asset allocation.

• Identifying Profitable Opportunities: By analyzing potential returns under different economic conditions, investors can spot undervalued assets that may offer strong growth potential.

• Comprehensive Risk Assessment: The inclusion of variance and standard deviation provides a clear picture of investment risk, helping investors select assets that align with their comfort levels.

Conclusion

The expected return calculator is more than just a mathematical tool—it is an essential resource for investors aiming to enhance decision-making and manage risk effectively. By offering a clear analysis of return probabilities and risk metrics, it simplifies the complexities of investment planning.

Whether you are a beginner seeking fundamental insights or a seasoned investor refining your portfolio strategy, incorporating this calculator into your investment approach can provide greater confidence, accuracy, and financial success. By leveraging its capabilities, investors position themselves to navigate financial markets with a data-driven, strategic mindset.

Frequently Asked Questions:

Business Model Innovation: We operate a group buying strategy, allowing participants to share costs and access popular courses at reduced prices. This model benefits individuals with limited financial resources, despite concerns from content creators about distribution methods.

Legal Considerations: The legality of our operations involves complex issues. Although we don’t have explicit permission from course creators to resell their content, there are no specific resale restrictions stated at the time of purchase. This ambiguity creates an opportunity for us to provide affordable educational resources.

Quality Control: We ensure that all course materials purchased are identical to those offered directly by the creators. However, it’s important to understand that we are not official providers. As such, our offerings do not include:

– Live coaching calls or sessions with the course author.

– Access to exclusive author-controlled groups or portals.

– Membership in private forums.

– Direct email support from the author or their team.

We aim to reduce the cost barrier in education by offering these courses independently, without the premium services available through official channels. We appreciate your understanding of our unique approach.

Be the first to review “The Expected Return Calculator” Cancel reply

You must be logged in to post a review.

Reviews

There are no reviews yet.