Wolfe Waves by Bill Wolfe

$3,000.00 Original price was: $3,000.00.$15.40Current price is: $15.40.

Detailed Review of Wolfe Waves by Bill Wolfe – Digital Download!

Wolfe Waves by Bill Wolfe

Overview

In-Depth Look at Bill Wolfe’s Wolfe Wave Trading Strategy

The Wolfe Wave pattern, created by Bill Wolfe, has become a vital tool for many traders aiming to anticipate and understand price movements in various financial markets. This innovative trading strategy, based on observing repetitive patterns in price action, equips traders to make well-informed decisions on potential market reversals. By incorporating this method into their trading practices, individuals can enhance their outcomes across stocks, forex, and commodities. This comprehensive review explores the core principles, framework, and practical use of Wolfe Waves, shedding light on its significance and credibility in the trading world.

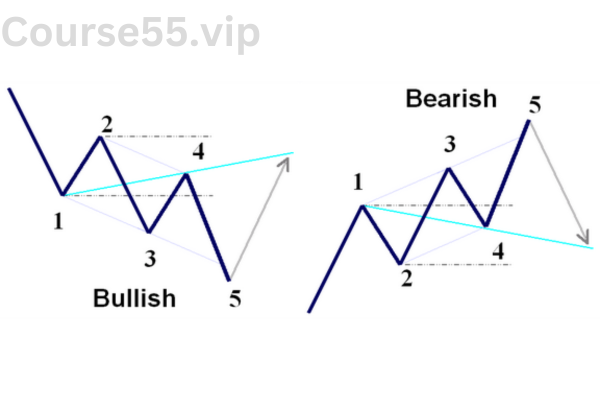

Breaking Down the Wolfe Wave Structure

The Wolfe Wave pattern is defined by a five-point structure, with each point symbolizing a specific action in the price movement. These points form a wave-like sequence that demonstrates a natural rhythm in price fluctuations, distinguishing it from many other technical analysis tools that heavily depend on complicated indicators.

Key Points of the Wolfe Wave:

-

Point 1: Marks the first high or low that initiates the wave pattern.

-

Point 2: Represents the initial counter-move against the prevailing trend, setting up the following points.

-

Point 3: A retracement that ideally confirms the trend’s direction.

-

Point 4: This crucial point signals the potential entry for traders looking to act on reversals.

-

Point 5: The final point, indicating where a reversal is likely to occur.

This setup helps traders assess whether the formation is indicative of a bullish or bearish trend. For instance, a bullish Wolfe Wave suggests opportunities to buy near Point 4, anticipating an upward price movement, while a bearish pattern indicates selling possibilities.

Market Trends and Behavior Insights

The flexibility of the Wolfe Wave method across various markets highlights its foundational principles. Traders particularly value it for capturing price reversals and understanding market behavior, all without relying on external technical indicators. As markets are often influenced by human psychology—specifically fear and greed—the repetitive nature of Wolfe Waves captures these psychological cycles effectively.

Additionally, the Wolfe Wave aligns with fundamental concepts from physics, such as Newton’s first law, which states that for every action, there is an equal and opposite reaction. In trading, this principle suggests that significant price movements in one direction are typically followed by corrective actions, a critical insight traders leverage when using Wolfe Waves.

Applying the Wolfe Wave Strategy in Trading

Effectively implementing the Wolfe Wave strategy requires a structured approach. Experienced traders often follow a step-by-step process to ensure accuracy and success in their trades.

-

Identifying Wolfe Wave Formations: The initial task is recognizing the pattern of the Wolfe Wave on price charts, focusing on the five key points.

-

Assessing Trend Direction: Understanding whether the pattern suggests a bullish or bearish reversal is essential for planning entry and exit strategies.

-

Setting Price Targets: Traders use the geometric properties of these waves to establish price targets, enhancing risk management. This approach ensures both the protection of investments and the maximization of potential profits.

Case Study Example

To illustrate the practical use of the Wolfe Wave, imagine a trader spotting a bullish pattern. The ideal entry point would be at Point 4, anticipating a significant price increase as the wave progresses toward Point 5. A stop-loss would also be set to minimize risk, demonstrating how the structure of the Wolfe Wave supports sound risk management practices.

Bill Wolfe’s Teaching Approach

Bill Wolfe’s teaching philosophy focuses on practical application, deviating from conventional strategies that heavily rely on various external indicators. His method emphasizes understanding the natural flow of price movements. In his courses, traders learn to identify and trade Wolfe Wave patterns effectively, incorporating these insights into their strategies for a deeper understanding of market dynamics.

Wolfe strongly believes that understanding the configuration and rhythm of price action is more powerful than relying solely on technical indicators. By embracing his techniques, traders can cultivate a comprehensive grasp of market behavior, which significantly enhances their decision-making abilities.

Why Traders Prefer Wolfe Waves

The Wolfe Wave strategy has gained popularity among traders for its simplicity and effectiveness. Here’s a summary of the key benefits:

-

Clarity and Simplicity: The five-point structure simplifies analysis, making it easier for traders to spot opportunities without the complexity of numerous indicators.

-

Reversal Identification: The Wolfe Wave pattern is inherently designed to pinpoint potential reversals, allowing traders to capitalize on major price shifts.

-

Effective Risk Management: The clear structure of the wave makes it easier to incorporate effective risk management strategies, crucial for safeguarding capital and maximizing returns.

-

Adaptability Across Markets: This approach can be used across a variety of financial markets, making it suitable for different trading styles, from day trading to long-term investing.

Important Considerations for Traders

While the Wolfe Wave method offers numerous advantages, traders should be mindful of the following factors when using this strategy:

-

Market Conditions: The effectiveness of the Wolfe Wave can be influenced by market volatility or prevailing conditions, requiring traders to remain flexible and responsive.

-

Comprehensive Analysis: For optimal results, it’s beneficial to combine the Wolfe Wave strategy with other forms of analysis, such as fundamental analysis or sentiment indicators. This enhances market insights and strengthens trading decisions.

Conclusion

In conclusion, the Wolfe Wave pattern, created by Bill Wolfe, stands as a powerful and effective trading strategy. By understanding its simple structure and inherent market rhythms, traders can make better predictions about potential price movements and reversals. The method’s focus on price action, rooted in principles of human psychology and market behavior, underscores its value. As a result, the Wolfe Wave continues to be a trusted tool for traders across various financial markets. By mastering this strategy, traders can enhance their decision-making abilities and increase their chances of success in the ever-changing landscape of financial markets.

Frequently Asked Questions:

Business Model Innovation: We operate a group buying strategy, allowing participants to share costs and access popular courses at reduced prices. This model benefits individuals with limited financial resources, despite concerns from content creators about distribution methods.

Legal Considerations: The legality of our operations involves complex issues. Although we don’t have explicit permission from course creators to resell their content, there are no specific resale restrictions stated at the time of purchase. This ambiguity creates an opportunity for us to provide affordable educational resources.

Quality Control: We ensure that all course materials purchased are identical to those offered directly by the creators. However, it’s important to understand that we are not official providers. As such, our offerings do not include:

– Live coaching calls or sessions with the course author.

– Access to exclusive author-controlled groups or portals.

– Membership in private forums.

– Direct email support from the author or their team.

We aim to reduce the cost barrier in education by offering these courses independently, without the premium services available through official channels. We appreciate your understanding of our unique approach.

Be the first to review “Wolfe Waves by Bill Wolfe” Cancel reply

You must be logged in to post a review.

Outbursts, Oppositional Defiance and Frustration in the Classroom: Self-Regulation Techniques to Reduce the Frequency, Severity and Duration of Problematic Behavior By Laura Ehlert - PESI

Outbursts, Oppositional Defiance and Frustration in the Classroom: Self-Regulation Techniques to Reduce the Frequency, Severity and Duration of Problematic Behavior By Laura Ehlert - PESI

Reviews

There are no reviews yet.